SERIOUS ABOUT BUILDING IN WEB3?

If you're working on something real — let's talk.

Published On Aug 19, 2025

Updated On Aug 19, 2025

10 years.

16 network upgrades.

0 downtime.

That alone tells you why Ethereum’s history is worth understanding.

Over the last decade, Ethereum has transitioned from a smart contract experiment to the foundational coordination layer for an entirely new class of financial and governance systems.

Each upgrade, from Byzantium to The Merge, reflects more than a technical change. It represents a deliberate shift in how the protocol thinks about execution, security, and decentralisation.

In 2025, Ethereum is no longer a monolithic blockchain. It’s a modular trust infrastructure powering rollups, AVSs, and increasingly, real-world use cases.

To understand where it’s heading, you need to study how it got here.

This blog traces the key milestones in Ethereum’s evolution, from the first whitepaper in 2013 to the rollup-centric and restaking-driven architecture of today and explains why each transition mattered, validators, and protocol teams building on top of it.

Let’s get started.

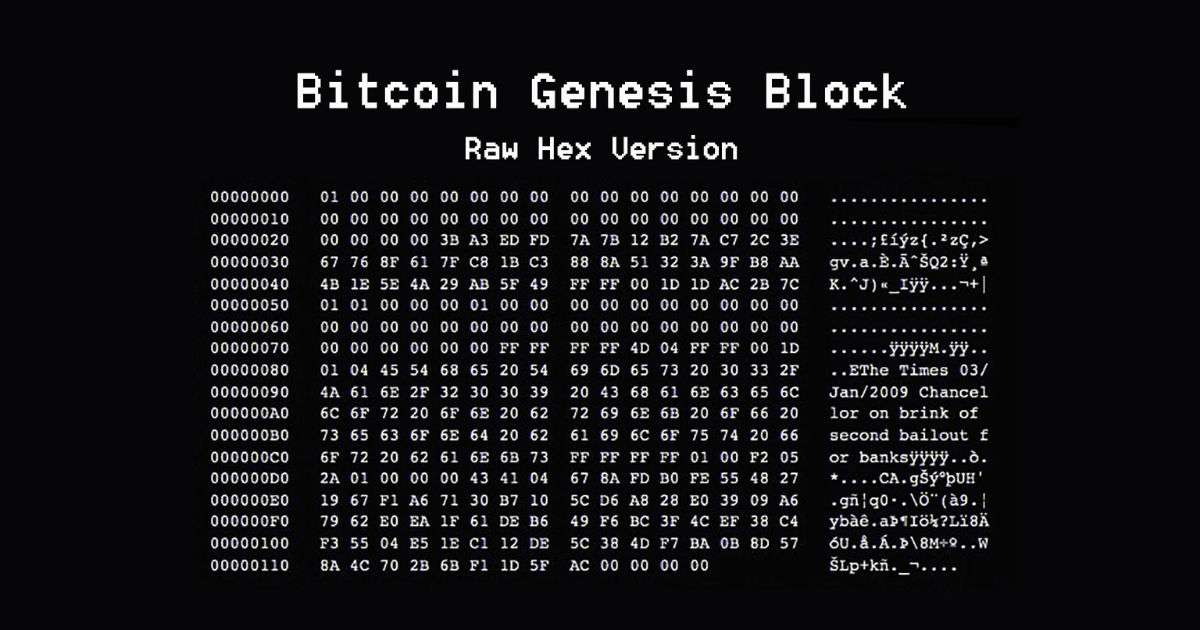

In late 2013, Vitalik Buterin, a programmer and early contributor to the Bitcoin ecosystem, published a whitepaper that introduced a fundamental shift in blockchain design: a general-purpose platform that could run arbitrary programs on-chain.

Unlike Bitcoin’s limited scripting language, Ethereum would allow developers to deploy trustless applications directly on the base layer.

The idea quickly attracted a group of early contributors who formalised the roadmap and worked to turn the concept into a live protocol.

In April 2014, Gavin Wood released the Yellow Paper, which provided the first formal specification of the Ethereum Virtual Machine (EVM).

A public crowdsale later that year raised approximately $18M in BTC, the largest open-source protocol fundraising at the time and created early alignment between token holders, developers, and the network’s long-term success.

Why This Phase Was Crucial

With the core vision established and early supporters aligned, the next challenge was turning the concept into a functioning network. That shift from theoretical design to live execution began with the Genesis Launch.

On 30 July 2015, Ethereum launched its Frontier network, the first public mainnet and a practical test of whether smart contracts could run reliably on a permissionless chain.

Frontier was intentionally released as a minimal developer-focused version of the protocol. There were no high-level abstractions or user-friendly tools.

Developers relied on a basic toolchain of Solidity, Geth, and the Mist wallet to deploy and interact with contracts.

Even in this restricted environment, the first wave of decentralised applications began to emerge, including early token issuance scripts, multisig wallets, and prototype registries.

These early dApps were not production-grade, but they validated the core thesis: programmable execution on a public blockchain could work.

Importantly, these first deployments also surfaced key limitations that are-

These practical bottlenecks directly influenced Ethereum’s next upgrades, i.e. Homestead and Byzantium, and pushed the community toward a more security-centric engineering culture.

The Genesis phase didn’t just mark the beginning of the network; it established the pattern that still defines Ethereum today: ship early → observe under real conditions → evolve the protocol accordingly.

This philosophy was about to face its first real stress test with an event that changed how the entire ecosystem thought about security and governance.

In mid-2016, Ethereum saw its first large-scale community experiment: The DAO, a decentralised investment fund that raised over $150M in ETH from more than 11,000 participants.

It was a public demonstration of what a DAO could look like in practice, token-holders collectively allocating capital without intermediaries.

Just weeks after launch, a critical reentrancy vulnerability in the smart contract was exploited, and ~3.6M ETH was siphoned into a malicious child contract.

The exploit didn’t compromise the Ethereum protocol itself, but it exposed a major gap: smart contracts could behave exactly as coded and still produce catastrophic outcomes.

The impact was immediate:

This decision triggered the creation of Ethereum Classic, as a minority group of nodes continued running the unforked chain.

Beyond the price impact, the DAO incident fundamentally reshaped Ethereum’s security philosophy and governance culture:

The DAO wasn’t just a setback; it was a foundational moment that led Ethereum toward a more security-mature, governance-aware ecosystem.

That maturity would become essential in the years that followed, as Ethereum faced a new challenge of a very different kind: scaling under real-world demand.

The period between 2017 and 2019 marked Ethereum’s transition from a developer-focused testbed to a live economic system.

Two key events accelerated this transition and exposed the limits of the network’s architecture.

More than $5.6 billion was raised through token sales launched on Ethereum in 2017 alone. This drove an unprecedented increase in on-chain activity:

For the first time, Ethereum was operating under real economic load, exposing early signs of scalability stress, and making it clear that the network would eventually need a new execution model.

In December 2017, CryptoKitties, a simple on-chain collectable NFT application that went viral and quickly became one of the most heavily used smart contracts on the network.

Transaction queues began to build up and block times increased, providing the first real-world demonstration that high-volume application traffic could saturate Ethereum’s base layer.

For the first time, the network became functionally congested, with hundreds of pending transactions and increased block times.

It demonstrated a critical insight: Ethereum could not handle high-volume application traffic without architectural upgrades.

Rather than immediately rebuilding the protocol, the community worked on two parallel tracks:

1. Scaling Research Accelerates

2. Infrastructure Matures

By the end of 2019, Ethereum had evolved beyond its “build-your-own tooling” stage.

An entire developer and infrastructure stack had emerged, but scalability remained the unsolved bottleneck. The community increasingly aligned around one conclusion:

Incremental optimisation wasn’t enough. Ethereum needed a structural shift to Layer-2 and modular design, and that shift became unavoidable as a new wave of applications drove the network into its next phase of growth.

By early 2020, Ethereum had become the protocol of choice for decentralised finance (DeFi).

Unlike ICOs, which were primarily fundraising mechanisms, DeFi protocols generated continuous on-chain activity via lending, trading, and yield strategies.

Total Value Locked (TVL) grew over a billion by November 2021, signalling a shift from speculation to utility.

This growth was driven by a new generation of composable primitives:

High transaction fees priced out many users and created a widening gap between infrastructure readiness and user demand.

This pushed the ecosystem toward Layer-2 solutions:

This period signalled a critical shift; Ethereum moved from being a single-chain execution environment to a multi-layer ecosystem, with the base layer acting as the settlement and security engine for activity happening elsewhere.

That new role set the stage for one of the most significant upgrades in the protocol’s history.

On 15 September 2022, Ethereum completed one of the most ambitious protocol upgrades in blockchain history: The Merge.

After running in parallel with the Beacon Chain for nearly two years, the network transitioned from Proof of Work (PoW) to Proof of Stake (PoS), combining the execution layer and consensus layer into a single PoS-based system.

Unlike previous upgrades, The Merge did not add new functionality or improve throughput. Its purpose was structural.

Why the Transition Mattered

This upgrade also demonstrated something rarely seen at this scale: a live blockchain changed its consensus mechanism without any downtime or network reset.

That success significantly increased institutional confidence and reinforced Ethereum’s position as the most adaptable base layer in Web3.

With the consensus foundation secured, the ecosystem shifted its focus toward a new priority: modularity and rollup-centric scalability.

Following the Merge, Ethereum shifted from optimising the base layer to outsourcing execution via rollups and modular components. This wasn’t just a performance improvement; it was a deliberate architectural redesign.

This became a key catalyst for: A surge in L2 user onboarding, with Base and zkSync both crossing more than a million active addresses.

The first wave of application-specific chains, where rollups function as independent execution layers while inheriting Ethereum security

By December 2024:

Together, rollups + restaking marked a structural transition: Ethereum moved from being a single blockchain to becoming a security and settlement layer for a growing modular ecosystem.

By 2025, that evolution entered a new phase as restaking, Layer-3s, and specialised AVSs began moving from experimentation to production.

In 2025, Ethereum’s modular architecture is no longer theoretical; it’s in production.

The ecosystem has moved beyond the first generation of general-purpose rollups into more specialised, application-specific Layer-3 networks that inherit security from both Ethereum and their parent rollups.

As Ethereum matures into a trust infrastructure layer, attention is turning toward its next scheduled milestone: the Pectra upgrade. Planned as a bundle of improvements, Pectra will bring validator usability upgrades (EIP-7002 withdrawals), gas efficiency optimisations, and further refinements to account abstraction.

In many ways, Pectra continues the same theme that defined Ethereum’s history: incremental yet impactful adjustments that unlock new layers of developer and user experience.

Ethereum’s evolution over the past decade is defined by one consistent pattern: adaptation through production experience.

Every major phase, from the DAO hack and DeFi surge to The Merge and rollup adoption, has pushed the protocol into new design territory, forcing it to rethink how execution, security, and governance should scale in an open network.

A few themes stand out:

Understanding this history isn’t about nostalgia. It’s about recognising that Ethereum’s long-term resilience comes from its ability to continuously adapt without compromising its core values: permissionless execution and cryptoeconomic security.

Ethereum was designed as a general-purpose blockchain that allowed developers to run decentralised applications (dApps) and smart contracts on-chain, unlike Bitcoin, which focused mainly on peer-to-peer value transfer.

The DAO Hack exposed a critical vulnerability in one of the earliest smart contracts and forced the community to make its first major governance decision, whether to fork the network. It shaped Ethereum’s approach to security, auditing, and decentralised decision-making.

Ethereum transitioned from Proof of Work to Proof of Stake in September 2022 during “The Merge.” This reduced energy consumption by roughly 99% and laid the foundation for modular scaling via rollups and data sharding.

The rollup-centric roadmap refers to Ethereum’s plan to migrate transaction execution to Layer-2 networks (rollups), while using the base layer for settlement and security. This makes the network significantly more scalable without sacrificing decentralisation.

In 2025, Ethereum is evolving into a modular trust infrastructure. Through restaking (EigenLayer) and specialised Layer-3 networks, protocols can leverage Ethereum’s security to build application-specific chains, shared sequencing layers, and new governance models.