SERIOUS ABOUT BUILDING IN WEB3?

If you're working on something real — let's talk.

Published On Aug 02, 2025

Updated On Feb 02, 2026

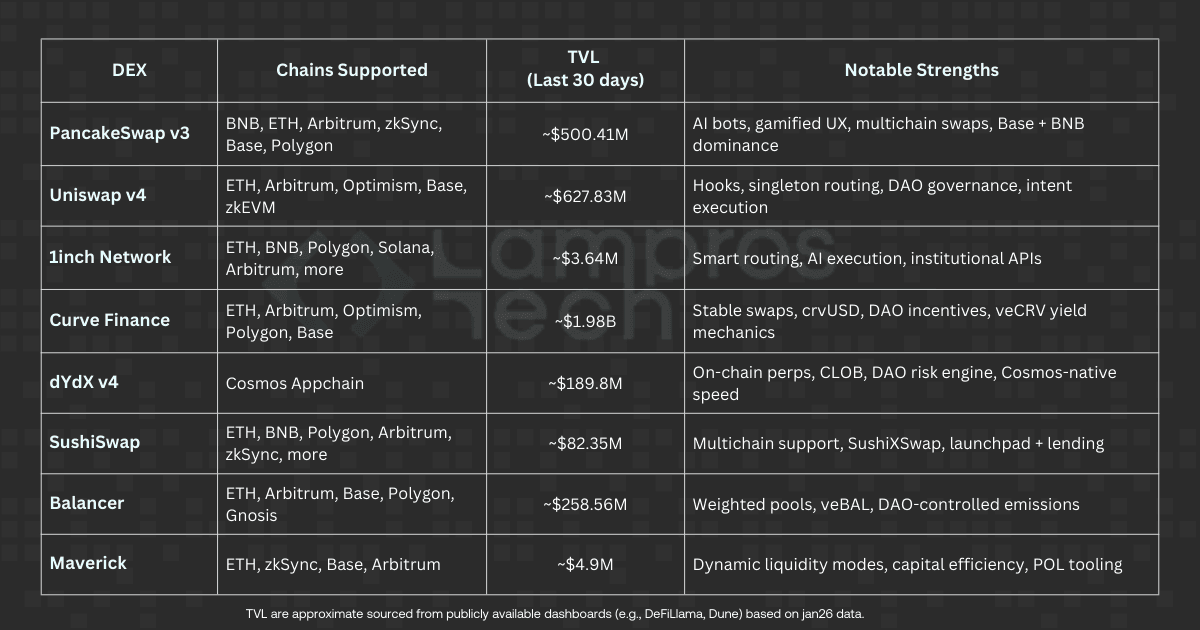

In 2026, DEX processed over $23 billion in volume, surpassing every previous record and closing the gap with centralised platforms like Binance.

But this growth isn’t just about avoiding custodians. It’s about performance, programmability, and control.

What’s driving the shift?

As DEXes evolve into modular, automated finance layers, understanding who’s leading and why it is critical for traders, protocols, and businesses alike.

This guide explores the 8 most important decentralised exchanges of 2026, backed by data, and shaped by what’s next.

Let’s break down.

Chains: BNB Chain, Ethereum, Arbitrum, Polygon, Base, zkSync, and more

PancakeSwap v3 is no longer just a BNB Chain-first DEX; it’s now the most actively used multichain exchange in the world. Its expansion across Ethereum and major Layer 2s, along with Binance-native infrastructure, has positioned it as the default choice for retail DeFi, especially in Asia and emerging markets.

In 2026, PancakeSwap’s strength lies in scale, execution speed, and broad accessibility. It offers the lowest entry barrier for new users while quietly integrating powerful features like AI bots and efficient cross-chain routing.

PancakeSwap v3 is designed for throughput and reach. The platform handles millions of daily transactions across chains and continues to lead in token listings, especially for new retail-focused assets.

Here’s what sets it apart:

These features make PancakeSwap a uniquely user-friendly DEX, one that blends simplified interfaces with under-the-hood automation, drawing in both newcomers and high-frequency users.

While not as DAO-heavy as some Ethereum-native DEXes, PancakeSwap maintains a track record of secure operations, third-party audits, and real-time community transparency dashboards. Governance is led by the PancakeSwap team with token-holder input, and upgrade cycles prioritise UX over protocol complexity.

Its lower governance friction has enabled faster integrations, new product rollouts, and ecosystem-wide promotions, all without waiting on DAO votes.

As part of Binance’s broader ecosystem, PancakeSwap operates with closer alignment to compliance discussions, particularly in Southeast Asia and the Middle East.

The platform supports geo-fenced access, interface localisation, and jurisdiction-aware onboarding flows, making it a viable option for KYC-friendly environments while preserving protocol openness elsewhere.

PancakeSwap v3 is the most used DEX in the world for a reason: it delivers speed, affordability, and reach without overwhelming users.

For founders targeting retail audiences or traders operating across chains daily, it’s the most accessible entry point into DeFi in 2026.

Chains: Ethereum Mainnet, Arbitrum, Optimism, Polygon zkEVM, Base

As DeFi matures into a modular and programmable ecosystem, Uniswap v4 is leading that shift from static liquidity pools to fully composable infrastructure. It’s no longer just a venue for token swaps; it’s a protocol layer teams are building on top of, optimising for, and integrating into increasingly complex workflows.

Uniswap v4 introduces several structural innovations that make it one of the most flexible and forward-compatible DEXes operating today.

These features combine to create a deeply programmable DEX architecture. The singleton design unifies all pools under a single contract system, which reduces fragmentation, improves routing efficiency, and makes it easier to coordinate liquidity across asset pairs and strategies.

Here’s what it enables:

The most powerful addition, however, is hooks, which are customizable logic modules that attach to liquidity pools. These allow developers and DAOs to define how pools behave in real time.

Hooks unlock:

All of this is coordinated through the Universal Router, which lets a single transaction span tokens, protocols, and user intents to streamlining operations for aggregators, smart wallets, and rollup-native dApps.

Uniswap v4 is governed by the UNI DAO, with a clear proposal process, active participation, and phased upgrade deployment. The protocol is regularly audited, and its bug bounty program remains one of the most robust in DeFi, prioritising both innovation and long-term security.

While the core contracts remain fully permissionless, Uniswap’s community and ecosystem are experimenting with decentralised frontends and optional KYC layers, giving regulated users and institutions the access they need without compromising composability or openness.

Uniswap v4 is a foundational layer for modular DeFi. If you're building systems that rely on composable, efficient, and programmable liquidity, this isn’t just a DEX; it’s part of your infrastructure.

Chains: Ethereum, BNB Chain, Polygon, Arbitrum, zkSync, Solana, Avalanche

1inch isn’t a DEX in the traditional sense; it’s an execution layer built on top of them. As the largest decentralised exchange aggregator, 1inch sources liquidity from hundreds of pools, routing each trade through the most efficient path across chains, protocols, and pricing curves.

In 2026, it remains the go-to venue for power users, aggregators, and institutional desks who care more about price efficiency and slippage control than any one protocol’s native UI.

The strength of 1inch lies in execution intelligence. It’s Pathfinder engine analyses liquidity across dozens of chains in real time, often splitting orders across multiple DEXes to minimise slippage, even for volatile or low-liquidity pairs.

Benefits include:

For institutional users, 1inch also offers access via APIs and custom execution endpoints, used by several DeFi wallets, bot systems, and on-chain hedge funds.

As a non-custodial aggregator, 1inch doesn’t hold user funds. It prioritises backend robustness through aggressive smart contract auditing, failover routing infrastructure, and granular control over slippage and gas parameters.

Governance is handled by the 1INCH token, with staking used for network reputation, feature prioritisation, and future liquidity incentive alignment.

1inch has gradually expanded into more compliance-aware territory. Its frontend now supports jurisdiction-aware interfaces and partners with KYC-friendly on/off ramps, particularly useful for enterprise or regulated DeFi strategies.

It also offers custom whitelisted frontends for partners needing controlled environments, while leaving the core protocol open and permissionless.

1inch isn’t where liquidity lives, but it’s where liquidity is optimised. For users who value precision, price, and efficiency across multiple ecosystems, it remains an indispensable infrastructure layer in 2026.

Chains: Ethereum, Arbitrum, Optimism, Polygon, Base, and more

Curve has long been the backbone of stablecoin liquidity in DeFi, and in 2026, it remains the most capital-efficient venue for trading like-kind assets at scale.

While newer DEXes experiment with routing and execution layers, Curve continues to own the low-slippage, high-volume niche where stability and depth matter more than speed.

The platform is also evolving. With its TriCrypto, crvUSD, and liquid staking integrations, Curve is extending its reach beyond stables while doubling down on DAO-driven capital coordination.

Curve’s AMM design is purpose-built for assets that should trade close to 1:1, like stablecoin pairs (USDC/DAI, USDT/crvUSD), stETH/ETH, or even tokenised T-bills.

This allows it to offer lower slippage and higher volume capacity than most general-purpose DEXes.

Key differentiators:

Curve’s liquidity is also heavily composable, used across dozens of protocols for routing, collateral, and DAOs managing stable reserves.

Curve’s contracts have been audited repeatedly since 2020, and its governance system (based on vote-escrowed CRV) is one of the most actively used in DeFi.

That said, the protocol has occasionally faced operational risk, notably in 2023, with lessons learned reflected in tighter upgrade procedures and pool isolation mechanisms in recent releases.

Governance decisions now involve multi-chain deployment strategies, protocol integrations, and emission tuning, making veCRV one of the most politically powerful tokens in the ecosystem.

As a protocol focused on stable assets, Curve exists in a more regulation-sensitive corner of DeFi.

While the protocol remains fully permissionless, many frontends and integrations now support compliance-aware UX flows for enterprise or RWA-focused projects using Curve liquidity.

crvUSD’s adoption may eventually intersect with stablecoin licensing regimes, something the DAO is monitoring but not yet formally addressing.

Curve isn’t built for everything, but what it does, it does better than anyone. If your strategy revolves around stablecoins, staked assets, or DAO-aligned liquidity incentives, Curve remains one of the most reliable and capital-efficient tools in DeFi.

Chains: Cosmos SDK (Standalone Appchain)

dYdX v4 represents a full reimagination of DeFi derivatives, migrating from Ethereum Layer 2 to a fully sovereign appchain built on Cosmos.

This version of dYdX is now one of the only venues offering a fully decentralised, on-chain order book at scale for perpetual futures trading.

With a validator-run matching engine and zero gas fees for trading, it blends the speed and familiarity of CEX-like experiences with the transparency and composability of DeFi.

Unlike AMMs or swap-based DEXes, dYdX v4 supports true limit orders, market depth, and sophisticated trading tools for perps across BTC, ETH, SOL, AVAX, and more.

What makes it different:

This setup makes dYdX the only fully on-chain, high-liquidity platform rivalling CEXs for perps, without custodial trade-offs.

Governance is now fully on-chain, with DYDX token holders controlling the protocol’s economic parameters, upgrades, and treasury management.

Security relies on Cosmos consensus, appchain isolation, and battle-tested risk logic refined through years of derivatives trading on Ethereum L2.

In addition, dYdX maintains a robust insurance fund and is expanding automated liquidation protections and circuit-breakers in 2026to further reduce protocol-wide risk.

As a decentralised perpetuals platform, dYdX operates in a complex legal environment.

While the protocol itself remains permissionless, interfaces and region-specific access (e.g., U.S. traders) are increasingly managed via geo-fenced frontends, with optional KYC integrations for institutional APIs.

The DAO is actively exploring jurisdictional segmentation to maintain global access while complying with evolving derivatives laws.

dYdX v4 is DeFi’s closest parallel to a professional trading exchange, fully decentralised, capital-efficient, and fast.

For anyone building, hedging, or trading in the on-chain derivatives space, it’s the protocol that sets the benchmark in 2026.

Chains: Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, zkSync, Fantom, and others

SushiSwap has transformed from its “Uniswap fork” origins into a resilient, multichain DeFi platform with a global footprint.

While not the biggest DEX by volume, Sushi remains one of the most accessible and integrated exchanges, especially across emerging ecosystems, where it often serves as the first major liquidity venue.

In 2026, Sushi’s focus is clear: delivering a unified user experience across chains, supporting new DeFi protocols, and optimising for cross-chain swaps via SushiXSwap.

Sushi isn’t just a DEX, it’s an all-in-one DeFi suite that includes staking, lending, launchpads, and token distribution tools.

Notable innovations:

Its ability to operate in lower-liquidity markets and provide a full-stack suite makes it attractive for bootstrapping projects and frontier DeFi communities.

Sushi has weathered multiple leadership transitions and security reviews, but in 2026, it stands on more stable ground.

It’s governed by a decentralised community of token holders via the Sushi DAO, with treasury proposals, emissions planning, and protocol integrations all voted on through forums and on-chain processes.

Recent improvements include better on-chain upgrade management, enhanced bug bounty programs, and code reviews for SushiXSwap routing contracts.

Sushi remains permissionless at the contract level, but is actively exploring jurisdiction-aware frontends to support institutional DeFi use.

With its multichain architecture, regional deployment, and LayerZero-powered swaps, Sushi can selectively comply with regional regulations while keeping protocol logic fully decentralised.

SushiSwap may no longer be DeFi’s trend-setter, but it’s one of its most dependable generalists.

For multichain teams, early-stage protocols, or users in frontier markets, it’s a flexible, familiar, and deeply integrated part of the DeFi stack in 2026.

Chains: Ethereum, Arbitrum, Polygon, Base, Gnosis Chain, Optimism

Balancer is not a standard DEX; it’s a flexible liquidity protocol for building automated portfolio strategies on-chain.

By allowing pools with up to eight assets and arbitrary weights, Balancer gives DAOs, protocols, and LPs control over how capital behaves inside the AMM.

In 2026, Balancer stands out as the go-to platform for programmable liquidity and composable DeFi infrastructure, especially when paired with Layer 2 scaling and integrations with protocols like Aura and Revest.

Balancer turns the traditional AMM model into a capital management toolkit.

What sets it apart:

In 2026, many projects use Balancer as the backend for token launches, LP staking campaigns, or treasury diversification, all without writing new smart contracts.

Governance is managed by veBAL holders, who vote on pool incentives, protocol parameters, and grant distributions.

Security-wise, Balancer pools are modular and auditable, with isolated risk per pool design. Its use of trusted relayers and controlled access guards critical functions like flash swaps and custom hooks.

Balancer remains permissionless and composable at the contract level, while frontends and integrations are moving toward region-aware experiences.

Some DAO-created pools on Balancer now explicitly support KYC-gated access or enterprise-only LP vaults, especially for RWA and institutional liquidity pools.

Balancer is not a consumer-first DEX; it’s infrastructure for programmable liquidity.

If you’re designing economic systems, treasury products, or DeFi-native structured assets in 2026, Balancer is the platform that lets you build them without reinventing the wheel.

Chains: Ethereum, zkSync Era, Base, Arbitrum

Maverick isn’t just another AMM; it’s a precision-tuned liquidity engine built for active capital deployment.

In 2026, as protocols seek to maximise efficiency and minimise idle liquidity, Maverick Protocol stands out with its Dynamic Concentrated Liquidity (DCL) model that automates LP positioning based on price movement.

Think of it as a middle ground between Uniswap v3’s manual range setting and passive AMMs like Curve, except with automation built into the core.

Maverick’s design gives LPs more control with less manual intervention. LPs choose how their liquidity responds to price movement, whether it follows the market (momentum mode), stays static, or rebalances bidirectionally.

Why it matters in 2026:

These innovations make Maverick a top choice for teams optimising emissions, DAO treasuries deploying active liquidity, and users seeking lower-risk LP exposure.

Maverick’s contracts are audited and structured for modular pool design.

While governance is still early-stage compared to Uniswap or Balancer, its roadmap includes expanding tokenholder involvement and launching MAV token-based vote mechanisms for pool incentives and protocol parameters.

The protocol is gaining traction with blue-chip DeFi teams, who use it to bootstrap controlled liquidity environments with less dependency on mercenary LPs.

Maverick operates permissionlessly at the protocol level, with no centralised gatekeeping.

However, several frontend deployments and integrations now support region-aware interfaces or DAO-governed pool access control, especially for liquidity tied to RWAs or regulated tokens.

Maverick is a DEX built for precision. For teams optimising liquidity cost, minimising idle capital, or launching incentive-aligned trading environments, it’s one of the most innovative AMMs in 2026.

Under the hood, today’s top DEXes are no longer just reacting to market activity; they’re actively shaping it.

From execution layers that interpret user intent to AI models optimising liquidity flows in real time, decentralised exchanges in 2026 are increasingly defined by what happens before and between trades, not just during them.

Several of these structural shifts are already reshaping the DEX stack:

We explored these trends in depth in our piece on Top DEX Trends in 2026, including what they mean for protocol teams, traders, and infrastructure builders navigating this new phase of on-chain markets.

Decentralised exchanges in 2026 are no longer just alternative trading venues; they are infrastructure.

Whether it's PancakeSwap’s scale, Uniswap v4’s modular liquidity engine, or dYdX’s fully on-chain derivatives stack, today’s leading DEXes represent a new layer of programmable finance that stretches across rollups, appchains, and emerging protocols.

What sets this generation apart isn't just decentralisation, it's performance, composability, and design built for scale.

For traders, that means faster, cheaper, and more intelligent execution. For DAOs and protocols, it means liquidity that can be governed, automated, and aligned with treasury goals.

And for builders, it’s a wide-open field to create new financial workflows on top of the most powerful liquidity rails on-chain.

Building DeFi infrastructure in 2026 means choosing DEXes not just for liquidity, but for architecture, automation, and resilience.

At Lampros Tech, we help teams design programmable liquidity systems across L2s and appchains.

Explore our DEX development services or book a call to get started.

The best DEX depends on your needs. Uniswap v4 leads in flexibility, while dYdX excels in derivatives and Jupiter dominates Solana routing.

Evaluate DEXs by infrastructure fit, liquidity depth, execution quality, security, and regulatory features.

Platforms like 1inch, Jupiter, and PancakeSwap offer cross-chain routing across EVM and non-EVM chains.

Yes. Most L2 DEXs like those on Arbitrum or Base offer lower gas fees and faster confirmation times.

Key features include intent-based execution, smart routing, DAO governance, and MEV protection tools.

DEX Infrastructure

Talk to our team about building intent-based, cross-chain, and MEV-safe trading systems.

Let’s Talk