SERIOUS ABOUT BUILDING IN WEB3?

If you're working on something real — let's talk.

Published On Sep 22, 2025

Updated On Sep 22, 2025

In 2020, the question was whether DeFi could attract liquidity at all. Incentives attracted users, but most ecosystems appeared fragile once the rewards disappeared.

By 2025, that debate is over. DeFi secures hundreds of billions across lending, staking, and swaps, and it now functions as the financial base layer of Web3.

The real question isn’t will liquidity come? But which protocols can hold it once it’s there?

Today’s leaders don’t rely on token subsidies. They compete on fundamentals:

For builders, DeFi is no longer an optional add-on; it is a necessity. For executives and investors, it remains the clearest signal of adoption, visible in fees, TVL, and sustainable fee capture.

This blog examines how DeFi has matured into the settlement layer of crypto and which protocols are positioned to lead in 2025.

Let’s get started.

Not every metric in DeFi tells the truth. Wallet counts and “daily active users” can be inflated by incentives, while TVL spikes often vanish as quickly as they appear.

What really matters is resilience: holding liquidity when rewards fade, generating consistent fees, and attracting builders who keep shipping.

To track that, we focus on five dimensions that are measurable across chains, comparable over time, and grounded in trusted data.

For fees data is taken from Token Terminal, liquidity from DeFiLlama, developer activity from Electric Capital and Artemis, and ecosystem baselines from L2BEAT.

For comparability, our analysis zeroes in on five core dimensions:

Other factors like protocol-owned liquidity (POL), oracle risk, or reliance on DA layers are still critical, but they vary widely across protocols. Instead of forcing them into one table, we highlight them in the protocol deep dives, where their impact can be assessed in context.

Numbers reveal what narratives often conceal. If trends like intent-based trading or protocol-owned liquidity explain how DeFi is evolving, snapshots show who is executing on them today.

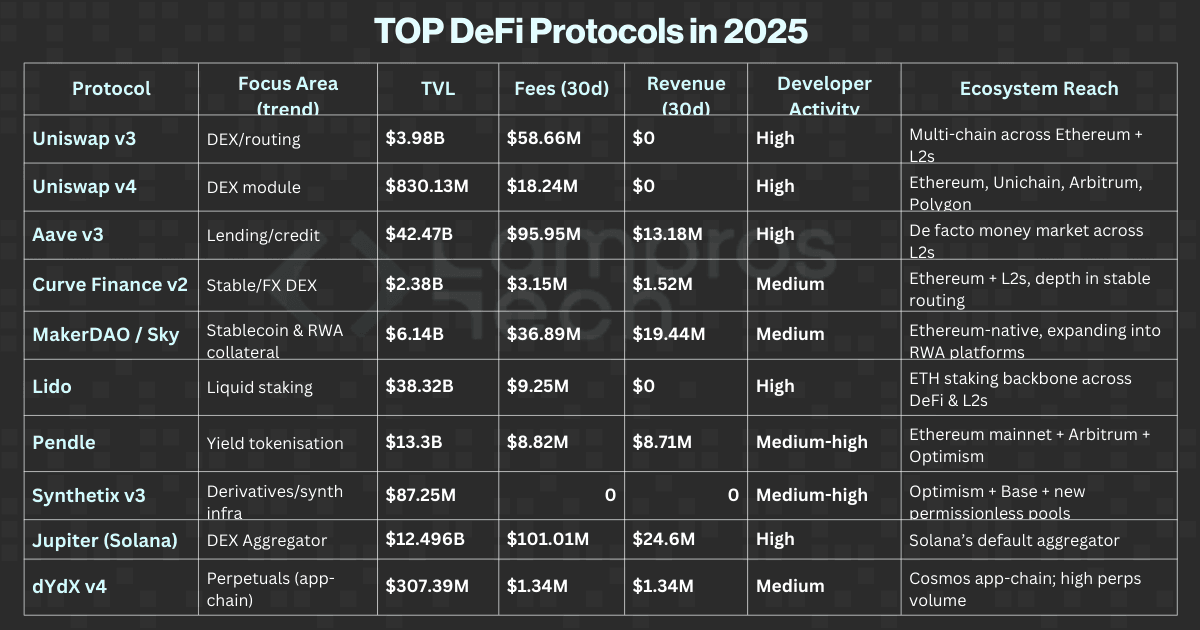

The table below brings together the signals that matter most for DeFi, like fees, revenue capture, developer activity, and ecosystem reach, so you can see which protocols are sustaining adoption, which are scaling across chains, and which are still struggling to convert usage into durable economics.

All figures are based on 30-day rolling windows, sourced from public platforms such as DeFiLlama, Token Terminal, and Artemis, and were last updated in September 2025.

The snapshot makes one thing clear: DeFi’s leaders aren’t defined by TVL alone, but by how they balance usage, economics, and reach.

Here, we keep the lens on DeFi alone to understand where liquidity and resilience really sit today.

Next, we’ll move into Protocol Deep Dives: Grouped by Function to see how these protocols stack up within trading, credit, staking, and derivatives.

Not every DeFi protocol solves the same problem, and comparing them side by side without context can be misleading. To bring clarity, we’ve grouped the leaders into four functional categories that reflect how builders and users actually interact with DeFi in 2025:

Each category represents a distinct layer of DeFi’s evolution, i.e. from liquidity rails to credit backbones to yield and risk markets.

In the next sections, we’ll explore what these protocols do, the 2025 signals that define their performance, and why they matter for builders, analysts, and investors.

Liquidity is the lifeblood of DeFi. It’s where users first touch the system, like swapping tokens, providing collateral, and routing stablecoins, and it’s where builders get the strongest signal of adoption.

In 2025, liquidity hubs have evolved far beyond the simple AMMs of 2020. They now offer programmable execution, stable FX rails, and aggregator networks that turn intent into outcomes.

Let’s look at how the leading liquidity protocols like Uniswap v4, Curve v2, and Jupiter are shaping this landscape.

Uniswap v4 pushes beyond the AMM model by introducing “hooks”, which are modular extensions that let developers customise how liquidity pools behave.

Instead of traders manually picking which pool to use, they can now define outcomes like lowest slippage or best execution, and the protocol automatically finds the path.

For developers, hooks unlock new design space: dynamic fee structures, custom AMM logic, and even built-in MEV protection.

The result is a shift from manual pool selection to intent-driven execution, making Uniswap v4 less of a single protocol and more of a platform for programmable liquidity.

Key 2025 signals

Why it matters

For builders, Uniswap v4 reduces integration overhead: instead of custom routing logic, apps can rely on hooks to deliver outcomes.

Builder takeaways

Curve remains the backbone of stable asset swaps and FX pools.

Curve v2 extends this with dynamic pricing curves and POL strategies, where Curve itself supplies liquidity rather than depending only on outside LPs. This reduces fragility during liquidity shocks.

Key 2025 signals

Why it matters

Curve’s value isn’t in raw volume anymore; it’s in stability. Its POL experiments are early signs of DeFi protocols building resilience into their own liquidity base, instead of renting mercenary capital.

Builder takeaways

Jupiter has become Solana’s default aggregator, handling intent-style trades across dozens of DEXs.

It’s where most Solana swaps happen, and it’s integrated by default into wallets and apps across the ecosystem.

Key 2025 signals

Why it matters: Jupiter shows that intent-based trading isn’t just an Ethereum trend. On Solana, it’s the default.

For builders, it means a single integration brings access to the majority of Solana liquidity. For analysts, it’s proof that aggregators can become ecosystems in themselves.

Liquidity hubs decide where trades clear and assets move. But lending and stablecoin systems decide what those assets can actually do, whether they earn, borrow, or back credit flows.

Credit rails decide how capital gets priced and where leverage shows up.

For builders, these protocols are the backbone for deposits, borrowing, and stablecoin liquidity; for analysts, they’re where revenue models and risk controls get tested in the open.

In 2025, Aave v3 and MakerDAO’s Sky are the ones defining that layer.

Aave v3 lets users supply assets to earn yield and borrow against collateral across multiple L2s and L1s.

The v3 design adds isolation mode, efficiency mode, and risk tooling that allow new assets without blowing up systemic risk.

Key 2025 signals (last 30 days):

Why it matters:

Builder takeaways:

Maker(Sky) mints a decentralised stablecoin and allocates collateral heavily into real-world assets (e.g., U.S. Treasuries) to generate a predictable yield that backs the system.

Key 2025 signals (last 30 days):

Why it matters:

Builder takeaways:

Credit markets price capital, but the security and yield base comes from staking. Without staking and structured yield, the system has no backbone.

Staking and structured yield have become the circulatory system of crypto.

ETH stakers provide the base security layer for rollups and apps, while protocols like Pendle turn future yield into a programmable market.

In 2025, these rails aren’t just passive income tools; they’re the foundation that underpins liquidity, governance, and even restaking economies.

Today, Lido and Pendle are at the centre of that layer.

Lido lets users stake ETH and receive liquid tokens (stETH), which can be used in DeFi while still earning validator rewards. It anchors billions in PoS security.

Key 2025 signals (latest):

Why it matters:

Builder takeaways:

Pendle lets users split yield-bearing tokens into principal and yield components. This enables hedging, trading, or structuring yield in more complex ways.

Key 2025 signals:

Why it matters:

Builder takeaways:

Yield powers liquidity, but governance and RWA integration decide whether protocols can adapt and plug into the broader economy. That’s where the next layer comes in.

If liquidity hubs move spot assets and credit markets price capital, derivatives decide how traders take risk and hedge exposure.

By 2025, this layer has matured from experimental synths into a core trading infrastructure that rivals centralised venues.

Two protocols define the category today: dYdX and Synthetix v3.

dYdX has been the flagship for decentralised perpetuals since 2021. With v4, the protocol made its boldest move yet: migrating from Ethereum L2s to a standalone Cosmos-based app-chain.

The shift gives dYdX full control over blockspace and sequencing, designed to scale high-volume perps trading with faster execution and reduced gas costs.

Key 2025 signals

Why it matters

dYdX v4 shows that perpetuals don’t have to live inside Ethereum’s rollup orbit.

By becoming an app-chain, it’s testing whether specialised blockspace can offer better performance and economics for high-frequency traders.

For analysts, it demonstrates that app-chains can support real trading markets if they pair deep liquidity with fast matching engines.

Builder takeaways

Synthetix has long been the backbone of on-chain derivatives.

With v3, it enables permissionless creation of synthetic assets, from FX pairs and commodities to new yield-bearing instruments, backed by pooled liquidity.

This shift makes Synthetix less of a single-product system and more of a derivatives infrastructure layer.

Key 2025 signals:

Why it matters

Builder takeaways

DeFi in 2025 isn’t an add-on; it’s the liquidity base and financial infrastructure that everything else builds on. The leaders are the ones who moved past incentives and built durability through integrations, security, and multi-chain reach.

For builders, DeFi is the first filter: if the liquidity isn’t durable and integrations aren’t compounding, the rest of the stack won’t matter.

For investors and analysts, it signals which ecosystems can weather shifts and still generate real fees.

At Lampros Tech, we help teams cut through noise, design token-efficient systems, and align with the protocols that last.

The leading DeFi protocols in 2025 include Aave v3, Uniswap v4, MakerDAO (Sky), Lido, Pendle, Jupiter, Curve v2, dYdX, and Synthetix v3. Each plays a different role, from credit markets and liquidity hubs to staking, yield tokenisation, and derivatives infrastructure.

DeFi has matured into the financial backbone of Web3, securing hundreds of billions across lending, staking, swaps, and derivatives. Unlike the incentive-driven cycles of 2020, today’s leaders compete on efficiency, integrations, and liquidity stability, making DeFi a core settlement layer for the crypto economy.

As of September 2025, Jupiter dominates fee generation on Solana with ≈ $101M in monthly fees, while Aave leads in TVL ($42.4B) and sustainable revenue capture ($13.2M). Meanwhile, Lido anchors Ethereum security with over $38B in staked ETH.

Protocols are evaluated on five key metrics:

RWAs have become systemic in 2025. MakerDAO (Sky) leads with tokenised U.S. Treasuries and other assets backing DAI, generating ≈ $19.4M in monthly retained revenue. RWAs provide predictable yield streams, reduce reliance on token incentives, and attract institutional liquidity into DeFi.

Scale with DeFi Liquidity

Power swaps, credit, and structured yield without building from scratch.

Schedule a Call