Contact Us

If you're working on something real — let's talk.

Development & Integration

Blockchain Infrastructure & Tools

Ecosystem Growth & Support

© 2026 Lampros Tech. All Rights Reserved.

Published On Oct 30, 2025

Updated On Oct 30, 2025

Growth Lead

FAQs

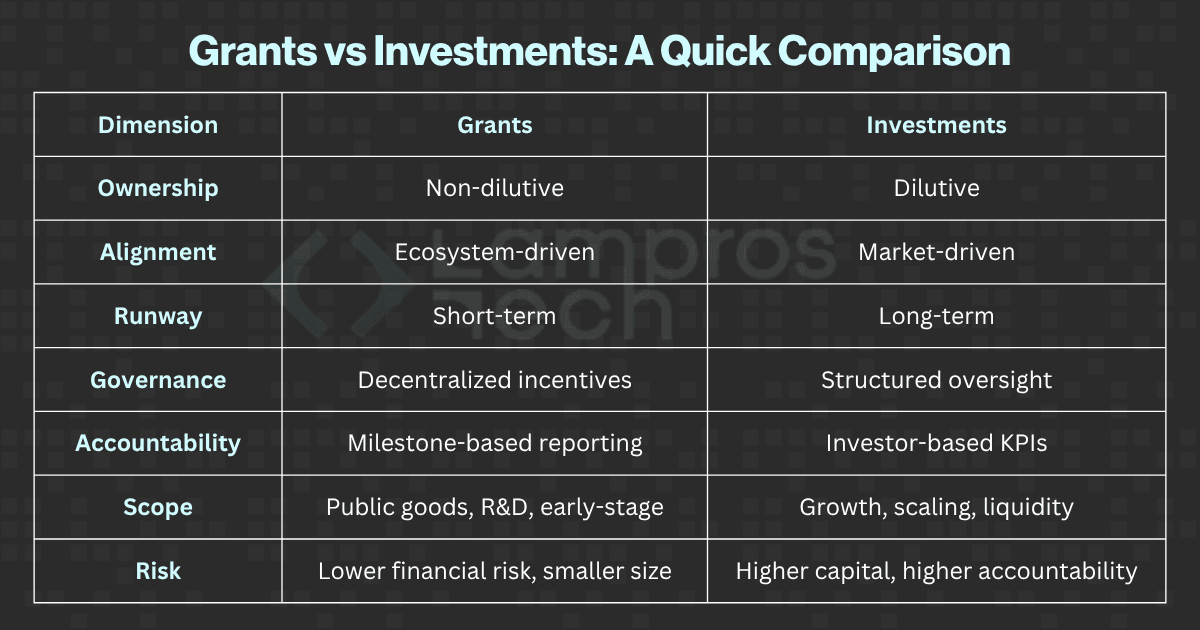

Web3 grants are non-dilutive ecosystem funding designed to support open-source development, while investments are dilutive capital exchanges that provide financial depth and scalability for protocols with proven traction.

Grants fund public goods, developer tooling, and infrastructure, reinforcing decentralization and transparency while aligning projects with ecosystem goals.

Early-stage teams should use grants for validation and community alignment; once traction and measurable impact are proven, investments help scale operations and liquidity.

Grants maintain autonomy and ecosystem credibility but offer limited capital; investments provide runway and market reach but introduce governance and ownership trade-offs.

Yes. Hybrid funding is an increasingly common protocols that validate through grants first and later attract strategic investors for scaling, balancing autonomy with growth.